tucson sales tax rate change

The City of Tucson tax rate increased effective July 1 2017 from 2 to 25 for most business activities and increased effective March 1 2018 from 25 to 26 for those same. This is especially important to note if you are an annual filer as the city tax rate has increased from the return filed for 2017.

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

The Tucson Sales Tax is collected by the merchant on all qualifying sales made within Tucson.

. Ad Find Out Sales Tax Rates For Free. As of March 1 2018 the local tax rate in Tucson is 26 on the following business classifications. As UA is exempt from the collection of City of Tucson sales tax for sales made by the UA this change will only apply to purchases from Tucson vendors located within the city limits.

Amusements Commercial rental leasing and licensing for use. 11518 to authorize a voter-approved sales tax increase of one tenth of a percent 01 to fund the Reid Park Zoo Improvement Fund. The minimum combined 2022 sales tax rate for Tucson Arizona is.

Fast Easy Tax Solutions. Effective July 01 2009 the per room per night surcharge will be 2. Simplify Arizona sales tax compliance.

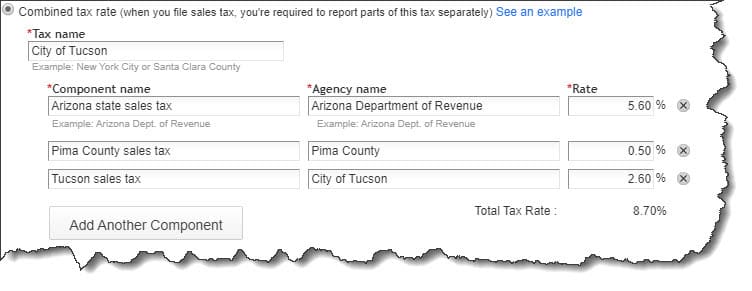

Effective July 01 2016 the per room per night surcharge will be 4. Tucson in Arizona has a tax rate of 86 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Tucson totaling 3. Salome Ehrenberg Bouse Wenden and Cibola.

Tucson AZ Sales Tax Rate. Effective July 01 2003 the tax rate increased to 600. The average sales tax rate in Arizona is 7695.

We provide sales tax rate databases for businesses who manage their own sales taxes and can also connect you with firms that can completely automate the sales tax calculation and filing process. The average cumulative sales tax rate in Tucson Arizona is 801. The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250 city sales tax.

Tucson is located within Pima County Arizona. See reviews photos directions phone numbers and more for Sales Tax Rate locations in Tucson AZ. Groceries are exempt from the Tucson and Arizona state sales taxes.

This is the total of state county and city sales tax rates. Method to calculate New Tucson sales tax in 2021. The City of Tucson tax rate increased effective July 1 2017 from 2 to 25 for most business activities and increased effective March 1 2018 from 25 to 26 for those same business activities.

The attached pdf contains the most recent changes to City Code Chapter 11 related to tax rates and license fees. The Tucson sales tax rate is. Tumacacori-Carmen AZ Sales Tax Rate.

City of South Tucson Tax Code effective 10-01-2019 150 KB Summary of Proposed Modified Fees draft 04-29-2019 for eff. 19-01 to increase the following tax rates. Tusayan AZ Sales Tax Rate.

A 1500 refrigerator purchased in Marana where the sales. This change has no impact on. Retail Sales 017 to five percent 50 Communications 005 to five and one-half percent 55 and Utilities 004 to five and one-half percent 55.

Sales Tax Rate for. This change has no impact on Arizona use tax assessment which remains at 56. This change has an effective date of October 1 2019.

4 rows The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima. Tucson AZ Sales Tax Rate. The December 2020 total local sales tax rate was also 8700.

The County sales tax rate is. Within Tucson there are around 52 zip codes with the most populous zip code being 85705. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

See reviews photos directions phone numbers and more for Sales Tax Rate locations in Tucson AZ. On July 15 2019 the Mayor and the Council of the City of South Tucson approved Ordinance No. You can find more tax rates and allowances for Tucson and Arizona in the 2022 Arizona Tax Tables.

Accordingly effective February 1 2018 the rate rose from 25 to 26 increasing the total retail sales tax rate in Tucson AZ from 86 to 87. This includes the rates on the state county city and special levels. Effective July 1 2017 the rate will rise from 20 to 25 increasing the total retail sales tax rate in Tucson AZ from 81 to 86.

The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250. Tucson Sales Tax Rates for 2022. On May 16 2017 Tucson resident voters approved a 5-year half-cent increase to the City of Tucson sales tax rate.

The state sales tax rate in Arizona is 5600. As the result of a Special Election held on November 7 2017 Mayor and Council adopted Ordinance No. The current total local sales tax rate in Tucson AZ is 8700.

Lowered from 76 to 66. Tubac AZ Sales Tax Rate. The following are the tax rate changes.

Tumacacori AZ Sales Tax Rate. Tucson Estates AZ Sales Tax Rate. TAX RATE CHANGES EFFECTIVE FEBRUARY 1 2018.

The Arizona sales tax rate is currently. The Arizona sales tax rate is 56 the sales tax rates in cities may differ from 56 to 112. If you need to buy a big-ticket item say a new refrigerator you could save some money by buying where the sales tax is lower.

With local taxes the total sales tax rate is between 5600 and 11200. Arizona has recent rate changes Wed Jan 01 2020.

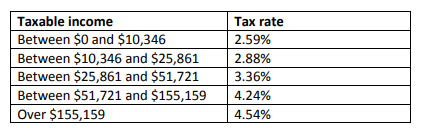

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

State And Local Taxes In Arizona Lexology

State And Local Taxes In Arizona Lexology

How To Charge Sales Tax Vat With Samcart Samcart

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Arizona Poised To Move To A Flat Tax Rate Beachfleischman Cpas

A Complete Guide On Car Sales Tax By State Shift

Prop 411 Tucson Votes To Extend Half Cent Sales Tax In Special Election The Daily Wildcat

Property Taxes In Arizona Lexology

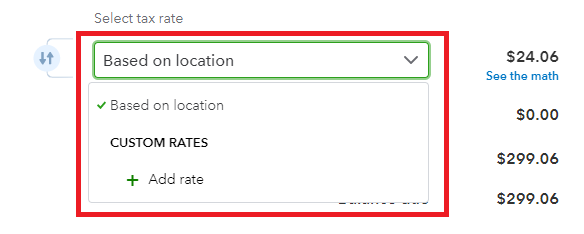

5 Things You Need To Know About Sales Tax In Quickbooks Online

How To Process Sales Tax In Quickbooks Online

Rate And Code Updates Arizona Department Of Revenue

Prop 411 Tucson Votes To Extend Half Cent Sales Tax In Special Election The Daily Wildcat

Arizona S Combined Sales Tax Rate Is Second Highest In The Nation Cronkite News